Significant Beneficial Ownership and Its Declaration under Companies Act, 2013

A.Introduction

Since its inception, Indian corporate law has undergone various transformations to ensure transparency and accountability. Historically, many entities and individuals have masked their identities to exercise control over Indian companies, often for tax evasion, illicit financial activities and regulatory avoidance. To address these concerns, the concept of Significant Beneficial Ownership (SBO) was introduced under the Companies Act, 2013 (“the Act”). This framework aims to bring corporate transparency and identify individuals who ultimately wield significant influence over a company’s operations.

The SBO rules represent a significant upgrade from India’s earlier corporate regulations, such as the Companies Act, 1956. Previously, determining who truly controlled a company’s shares or influenced its decisions was difficult, creating opportunities for entities to conceal illicit financial activities. As part of global efforts to combat money laundering and tax evasion, the updated rules aim to enhance transparency.

B.What is Significant Beneficial Ownership (SBO) and how to identify?

A significant beneficial owner (SBO) is a person who has a substantial interest or control in a company. This could be through shareholding, voting rights, or other means. Section 90 of the Companies Act read with the Companies (Significant Beneficial Owners) Rules, 2018 (SBO Rules) prescribe twin tests to find an individual who would qualify as Significant Beneficial Owner (SBO) of the reporting company:

·Objective test: 10% shareholding at the reporting company with a mandatory indirect shareholding alongwith possible direct shareholding of the said SBO and majority holding through the ownership chain.

·Subjective test: SBO having the right to exercise or actually exercising “significant influence” or “control” in any manner other than through direct holding alone.

Companies are required to identify such individuals by applying above principle and shall seek declaration from SBO in Form BEN-4.

C.Compliance Requirements for SBO and Companies

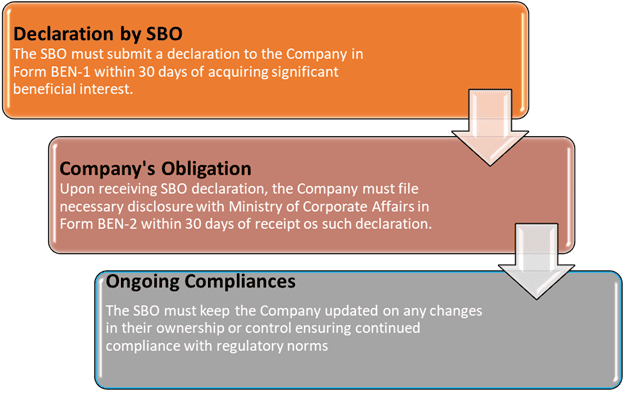

Once an SBO is identified, both the individual and the Indian company (“Company”) must comply with the following legal requirements:

D.Impact on Corporate Governance

The introduction of the SBO framework strengthens corporate governance by ensuring that companies disclose their true owners. This measure curtails tax evasion, prevents financial misconduct, and enhances investor confidence by providing greater transparency in business ownership structures.

By enforcing SBO regulations, India aims to align with global best practices in corporate compliance and accountability, fostering a more robust and transparent corporate environment.

DISCLAIMER

This document is not for public circulation and is meant only for intended recipient. It is not exhaustive and does not purport any opinions or suggestions. Any action taken on the basis of this compilation is strictly at your own risk and we shall not be held liable for the same. All right reserved.

Authored by CS. Sanat Chavan of RBKRS & ASSOCIATES LLP