Trumps Tariffs – How It May Affect India And The Global Economy

US President Donald Trump has announced a “Reciprocal Tariff Policy” on goods imported from other countries. Over 180 countries, including key trade partners of US like India, China, Vietnam and EU are now going to face these new tariffs. This move of Trumps has sparked the fear of a global recession, Trade war, supply chain disruption and economic slowdown. India may faces Challenges in various sectors due to these tariffs but may also gain certain competitive advantages due to higher tariffs on the major competitors.

Tariff – What is it?

Tariffs are the taxes levied on goods imported into a country. In simple words, it’s a tax imposed by the government on imported goods.

Example: India is one of the largest exporters of jewelry. Let’s say there is a piece of jewelry that costs $1,000 when made in India. Now, if the US government imposes a 26% tariff on this piece of jewelry, the final cost for consumers in the US would be $1,260. Tariffs are used by most governments as an economic tool to increase the prices of imported products, thereby encouraging people to buy locally made goods instead.

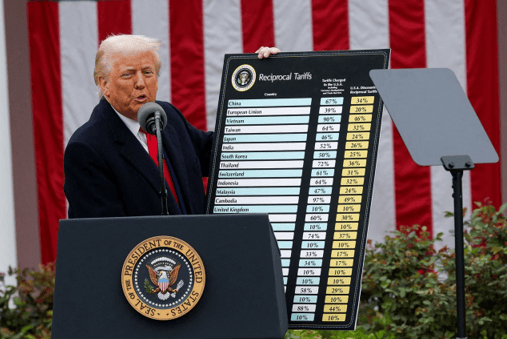

US President Donald Trump Announces Reciprocal Tariffs

On April 2nd, Trump announced reciprocal tariffs on other countries. This policy includes a 10% baseline tariff that will be imposed on all goods imported into the US. In addition, a discounted reciprocal tariff will be imposed, which is set at half the rate other countries charge on US products. The rate of the tariff imposed by the US will be based on the tariffs those nations impose on American goods. India faces a 26% tariff, which is higher than the tariffs on the EU (20%), Japan (24%), and South Korea (25%).Tariffs on China have increased to 145% in total, Vietnam to 46%, Cambodia to 49%, and Taiwan to 32%.More than 180 countries are affected by these reciprocal tariff.

Recently Donald Trump has announced a 90-day pause on these tariffs except for China whose tariffs are raised to 245% and all the Countries who didn’t retaliated against US tariffs will only face blanket tariff of 10% until July.

How It May Affect the World?

Risk of Global Recession

According to an American Multinational Investment Bank and Financial service provider, Goldman Sachsa recession is more likely due to the US government's tariff policy. They estimate a 45% chance of a recession in the next 12 months. One more leading American Multinational Financial Services firm, J.P. Morgan raised its forecast for a global recession by the end of the year from 40% to 60%. According to various Economists this policy would have a direct impact on households and businesses and could disrupt global supply chains. Imposing tariffs on all imports will increase costs for US businesses, leading to higher prices for US consumers. This could push the US into a recession, which may also impact other countries. “It will be difficult for the US to avoid a recession if the tariffs stay at the level that’s been announced,” said Claudia Sahm, chief economist at New Century Advisors, in a recent statement to TIME.

Tariff War/ Trade War

This move by Trump’s administration may trigger a trade or tariff war, which already appears to be unfolding between the US and China. In retaliation to US tariffs, China initially imposed a 34% tariff, which has now been increased to 84%. Canada has retaliated by imposing a 25% tariff on some US-made vehicles. EU member states have also voted to approve retaliatory tariffs on US goods.

Economic Slowdown in Export-Driven Countries

Countries like Canada, Mexico, Vietnam, South Korea, and others whose major export incomes come from the US may suffer economic slowdowns. For countries like Vietnam, Bangladesh, and Cambodia, losing even a small share of the market could be painful and may severely impact their economies. Vietnam, for example, manufactures almost 50% of Nike footwear. Due to tariffs, it may lose 40% of its total goods exports.

Increase in Global Inflation

Inflation is very likely to rise because of the tariffs. The policy increases the cost of imported consumer goods and raw materials used by businesses, leading to price hikes for the end consumer. Higher import costs will lead to increased inflation and reduced purchasing power. Federal Reserve Chair Jerome Powell said: “We face a highly uncertain outlook with elevated risks of both higher unemployment and higher inflation. While tariffs are highly likely to generate at least a temporary rise in inflation, it is also possible that the effects could be more persistent.”

Financial Market Volatility

Due to global uncertainty, volatility has surged in financial markets. The S&P 500 has plunged 20% from its recent peak, wiping out trillions in market value. The Dow Jones and NASDAQ have declined significantly. On April 7, Indian indices such as Sensex and Nifty experienced a steep fall. The Trump’s Tariff policy has introduced a wave of uncertainty, leading to increased market volatility, reduced investor appetite and a high risk across the global and Indian financial Market.

Impact of Trump’s Tariffs on India

Almost 18% of India’s exports go to the United States, where India currently enjoys a trade surplus of $36 billion (in FY 2023–24) and so India is likely to feel the heat of the Trump’s policy. Higher Tariff on the Indian exports could reduce the trade volume and impact the revenues in few sectors. While some sectors may see a short term set back, India could also find opportunities as competing nation faces steeper tariff.

Sectors Likely to Be Affected in India

Electronics Exports

The US imports nearly $14 billion worth of electronics from India. This sector is expected to be hit hard, as it previously paid only 0.41% in tariffs. The new tariff hikes could reduce exports to the US by 12% if the situation does not improve. More than 50% of India’s electronic exports consist of mobile phones, particularly Apple and Samsung devices assembled in India. This sector may see a decline in exports to the US. States like Tamil Nadu and Karnataka, which are major hubs for electronics manufacturing, are likely to be affected.

Gems and Jewelry

The US imports nearly $9 billion worth of gems and jewelry from India, accounting for 40% of India's total exports in this category. Previously, this sector faced a 2.12% tariff. Now, it may experience a 15% decline in exports to the US. India’s diamond sector, which exports over one-third of its production to the US, is likely to be severely affected. States like Gujarat and Maharashtra may see layoffs in the diamond sector. Officials indicate that consultations are ongoing with ministries and export associations to evaluate the consequences.

Agriculture and Seafood

The agricultural sector may remain resilient despite Trump’s reciprocal tariffs. Products like basmati rice, spices, tea, and coffee may see a temporary slowdown in exports, but long-term challenges are unlikely.According to the Global Trade Research Initiative (GTRI), the hardest-hit segments in agriculture would be fish, meat, and processed seafood.

Textiles

Nearly 28% of India’s textile exports go to the US. Despite the tariffs, the textile industry is expected to experience modest growth. According to Shiraz Askari, President of Apollo Fashion International Limited, “It will impact pricing and demand in the short term, but the fundamentals of the industry remain strong. India has built a robust supply chain, a skilled workforce, and strong manufacturing capabilities. Compared to countries like Vietnam and Bangladesh, which now face even higher tariffs, India still has a relative cost advantage.

Pharmaceuticals and Semiconductors

Previously, the Trump administration had exempted pharmaceuticals and semiconductors from the reciprocal tariff policy. However, Trump has now stated that a “major” tariff on pharmaceutical imports will soon be announced to encourage drug manufacturing in the US.The US is India’s largest export market for pharmaceutical goods, with Indian exports totaling $8.7 billion in FY 2024–25. Pharma companies like Dr. Reddy’s, Sun Pharma, and Aurobindo Pharma earn over 30% of their revenue from the US.If tariffs are imposed on this sector, both India and the US will be impacted. The US relies on India for affordable generic medicines, and such tariffs could lead to inflation and higher prices in the pharmaceutical sector.

Semiconductors

This sector remains exempt from Trump’s reciprocal tariffs, at least for now. However, products that use semiconductors—like mobile phones, computer systems, and GPUs—are not exempt. This may raise the cost of end products in which semiconductors are used.

Automotive Sector

The US is the largest importer of automobiles. In 2024, India exported automobile components worth approximately $21.2 billion, with 30% going to the US. Despite the 26% tariff in this sector, India has the potential to perform strongly, as major automotive exporting countries now face even higher tariffs. India can position itself as a competitive alternative by focusing on cost-effective production. Strategic government policies and export incentives can enhance India’s role in the global automotive supply chain.

IT Sector

The US is the largest importer of Indian IT services, making it a key market for Indian tech Companies. The Trump’s Reciprocal Tariff Policy mainly targets on physical goods rather than services. Since the IT sector is primarily service-based, these services are not subject to import tariffs.The Indian IT sector May not Face direct Tariffs but it could still be affected by the global economic slowdown

Will Trump’s Tariffs Create Opportunities for India?

According to a report published by Motilal Oswal, the US reciprocal tariffs will have a minimal impact on India’s GDP. The report estimates that the impact will be only 1.1% of India’s GDP. India’s exports to the US in six key sectors—electrical machinery, gems and jewelry, pharmaceutical products, machinery for nuclear reactors, iron and steel, and seafood—amount to approximately $42.2 billion. This figure represents about 1.1% of India's GDP.

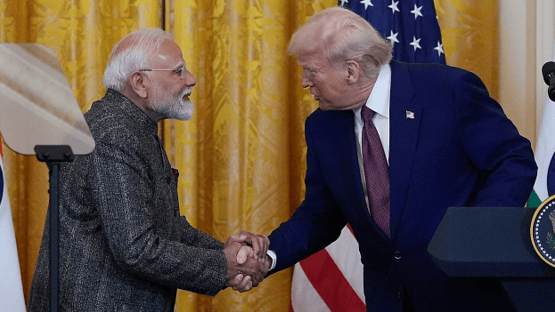

According to Goldman Sachs that India’s economy is likely to remain strong in an uncertain global environment. They expect India’s GDP to grow at an average of 6.5% between 2025 and 2030. Global economists believe that India will still be the fastest-growing economy in the world despite Trump’s tariffs. The 26% tariff on India is relatively low compared to the tariffs imposed on other countries, such as China (increased to 145% in total), Vietnam (46%), and Taiwan (32%). Higher reciprocal tariffs on several Asian economies create an opportunity for India to expand its presence in global trade and manufacturing. Moreover, during a visit by Prime Minister Narendra Modi to the US, India and the US launched “Mission 500” for bilateral trade. Under this ambitious initiative, both nations aim to more than double their total bilateral trade to $500 billion by 2030, according to a release from the Prime Minister's Office.

India’s Plan to Counter the Tariffs

To deal with the impact of the Us Tariff policy India is actively working on strengthening its global trade ties. Union Commerce and Industry Minister Piyush Goyal announced that India expects to conclude the first phase of its bilateral trade agreement (BTA) with the US under Mission 500 by the autumn of 2025. As part of the agreement, both sides will designate senior representatives to negotiate terms, strengthen trade in goods, reduce tariffs and non-tariff barriers, and enhance supply chains. He also mentioned India’s ongoing trade and economic partnership with EFTA countries—Switzerland, Norway, Iceland, and Liechtenstein—and similar negotiations with other countries that could benefit India. Additionally, the Ministry of Commerce and Industry is in continuous talks to enhance trade, investments, and technology transfer between India and its global partners.

Conclusion

In short, while Trumps policy presents risks for India’s exports and global trade stability, it also opens the door for strategic gains by actively engaging in trade negotiations and strengthening its global presence.

-Athoured by Mr. Bhavya Belani, Article Trainee at RBKRS & Associates LLP

Connect to Bhavya on LinkedIn - https://www.linkedin.com/in/bhavya-belani-5b2432258/