RELATED PARTY TRANSACTIONS: CORPORATE GOVERNANCE AT THE CROSSROADS

INTRODUCTION:

A company often engages in transactions with its related parties, including subsidiary and associate companies. These related party relationships are a common feature of business. However, due to the nature of these relationships, transactions between related parties may not be conducted on the same terms as those with unrelated parties. For instance, a company might sell goods to a related party at cost, a practice it wouldn’t extend to other customers. Such preferential treatment, whether in pricing, credit terms, or other conditions, can impact the company’s financial position and performance. To ensure fairness and transparency, the law mandates detailed compliance and disclosure requirements for transactions with related parties.

Effective corporate governance plays a critical role in ensuring these transactions are conducted transparently, fairly, and without bias, thereby preserving the trust of shareholders and stakeholders alike. However, when mismanaged or misused, RPTs can undermine the integrity of a company, erode shareholder value, and lead to serious ethical dilemmas. In this article, we explore the key provisions that private companies and unlisted public companies must follow to ensure proper handling of related party transactions.

LET’S UNDERSTAND WHAT IS RELATED PARTY WITH EXAMPLES:

As per Section 2(76) of the Companies Act, 2013, related party, with reference to a KPC Builders Private Limited (Company), means -

SR.NO. | RELATED PARTIES

| EXAMPLE |

1. |

A director or his relative | Mr. Amar and Mr. Dinesh are directors and the relatives of these Directors are considered as related parties. |

2. | A key managerial personnel or his relative

| Mr.Rohit is a Company secretary, his relatives will be considered related parties |

3. | A firm, in which a director, manager or his relative is a partner

| Mr. Amar is a partner at Legal Advisors LLP, another firm. This firm will also be considered as a related party. |

4. | A private company in which a director or manager [or his relative] is a member or director | Mr. Dinesh is a director in Shreeom Pvt. Ltd. – In this case Shreeom Pvt. Ltd. becomes a related party. Even when Mr. Dinesh’s relative is a member or director in Shreeom Pvt. Ltd., this company will be considered as a related party. |

5. | A public company in which a director or manager [and holds] is a director or holds along with his relatives, more than two per cent. of its paid-up share capital | Mr. Amar along with his relatives holds more than 2% of the paid-up capital of Finserv ltd. In this case, Finserv Ltd will be considered as a related party. |

6. | Any body corporate whose Board of Directors, managing director or manager is accustomed to act in accordance with the advice, directions or instructions of a director or manager | When Finserv Ltd acts on the directions of Mr. Dinesh, Finserv Ltd will be a related party. |

7. | any person on whose advice, directions or instructions a director or manager is accustomed to act | Mr.Omkar holding 51% in KPC Builders Private Limited on whose advice Mr. Amar has to act will be considered as a related party. |

8. | (A) holding, subsidiary or an associate company of such company; or (B) a subsidiary of a holding company to which it is also a subsidiary; (C) an investing company or the venturer of the company |

|

Not every transaction with a related party qualifies as a "related party transaction," although every "related party transaction" involves a related party. Such transactions are not inherently harmful. The concern arises when there is abuse due to conflicts of interest or non-arm's length dealings, which benefit the related party at the expense of other stakeholders. Issues like siphoning of funds and diversion of company resources also raise alarms. Therefore, transparency in related party transactions is crucial to ensure fairness and protect the interests of all stakeholders.

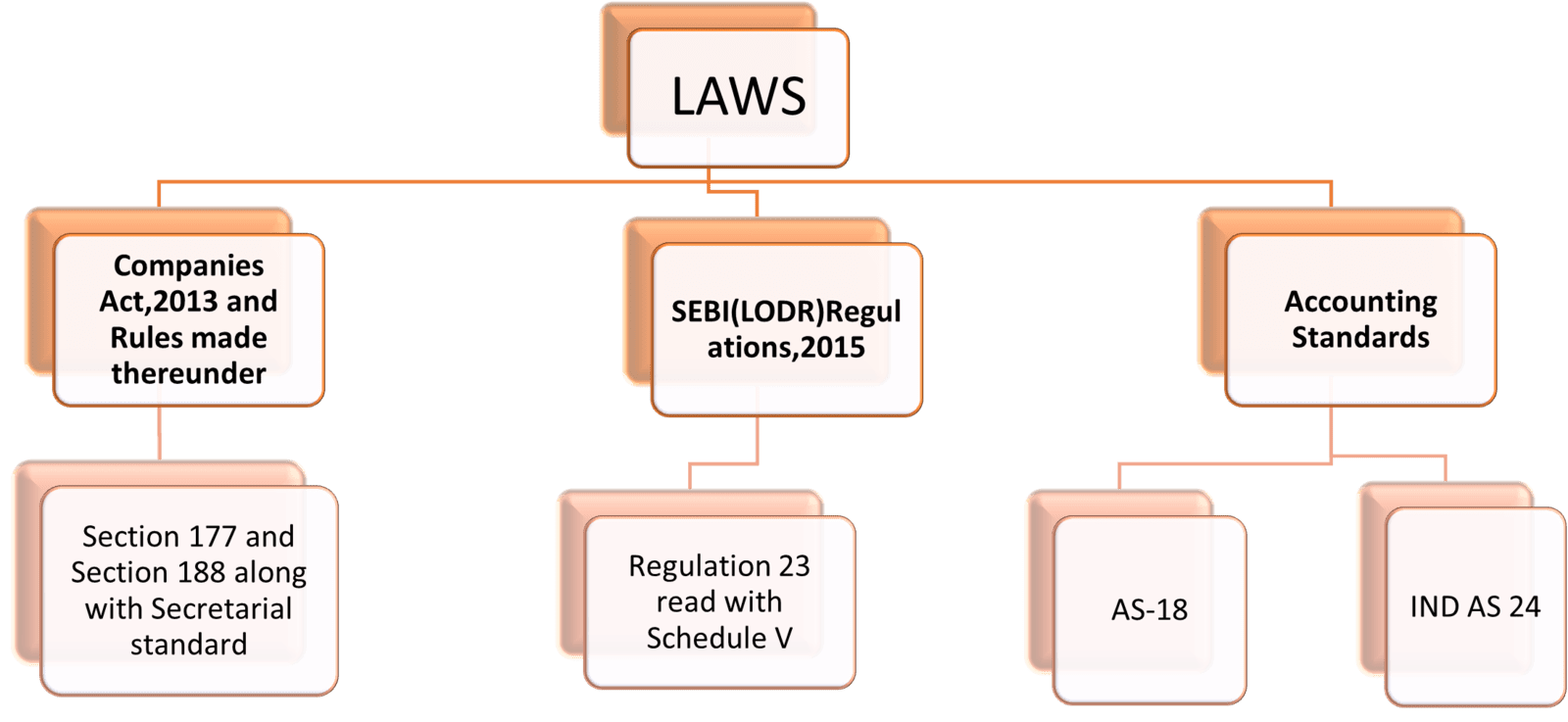

KEY LEGISLATIONS GOVERNING RELATED PARTY TRANSACTIONS:

WHAT IS THE MEANING OF RELATED PARTY TRANSACTIONS?

As per Section 188 of the Companies Act, 2013, the consent of the Board of Directors is required through a resolution passed at a Board meeting to enter into any contract or arrangement with a related party concerning the following Related Party Transactions –

Provided also that nothing in this section shall apply to any transactions entered into by the company in its ordinary course of business other than transactions which are not on an arm’s length basis.

WHETHER SHAREHOLDERS APPROVAL REQUIRED OR NOT?

Whenever a material Related Party Transaction (RPT) is to be entered into by the company, it must be approved by the shareholders through an ordinary resolution. Therefore, understanding what constitutes materiality is essential.

SR | TYPE OF TRANSACTION | MATERIAL LIMIT |

1. | sale, purchase or supply of any goods or materials directly or through appointment of agents | 10% or more of the annual turnover

|

2. | selling or otherwise disposing of, or buying, property of any kind directly or through appointment of agents

| 10% or more of net worth

|

3. | leasing of property of any kind | 10% or more of the turnover |

4. | availing or rendering of any services directly or through appointment of agents

| 10% or more of the turnover

|

5. | appointment to any place of profit in the company, its subsidiary or associate company at a monthly remuneration

| Monthly remuneration Exceeding Rs. 2.5 lakhs |

6. | remuneration for underwriting the subscription of any securities or derivatives thereof of the company

| Remuneration exceeding 1% of the net worth |

The limits specified in clause (1) to (4) shall apply for transaction or transactions to be entered into either individually or taken together with the previous transactions during a financial year.

What if transaction is between holding company and its wholly owned subsidiary?

In case of wholly owned subsidiary, the resolution is passed by the holding company shall be sufficient for the purpose of entering into the transaction between the wholly owned subsidiary and the holding company.

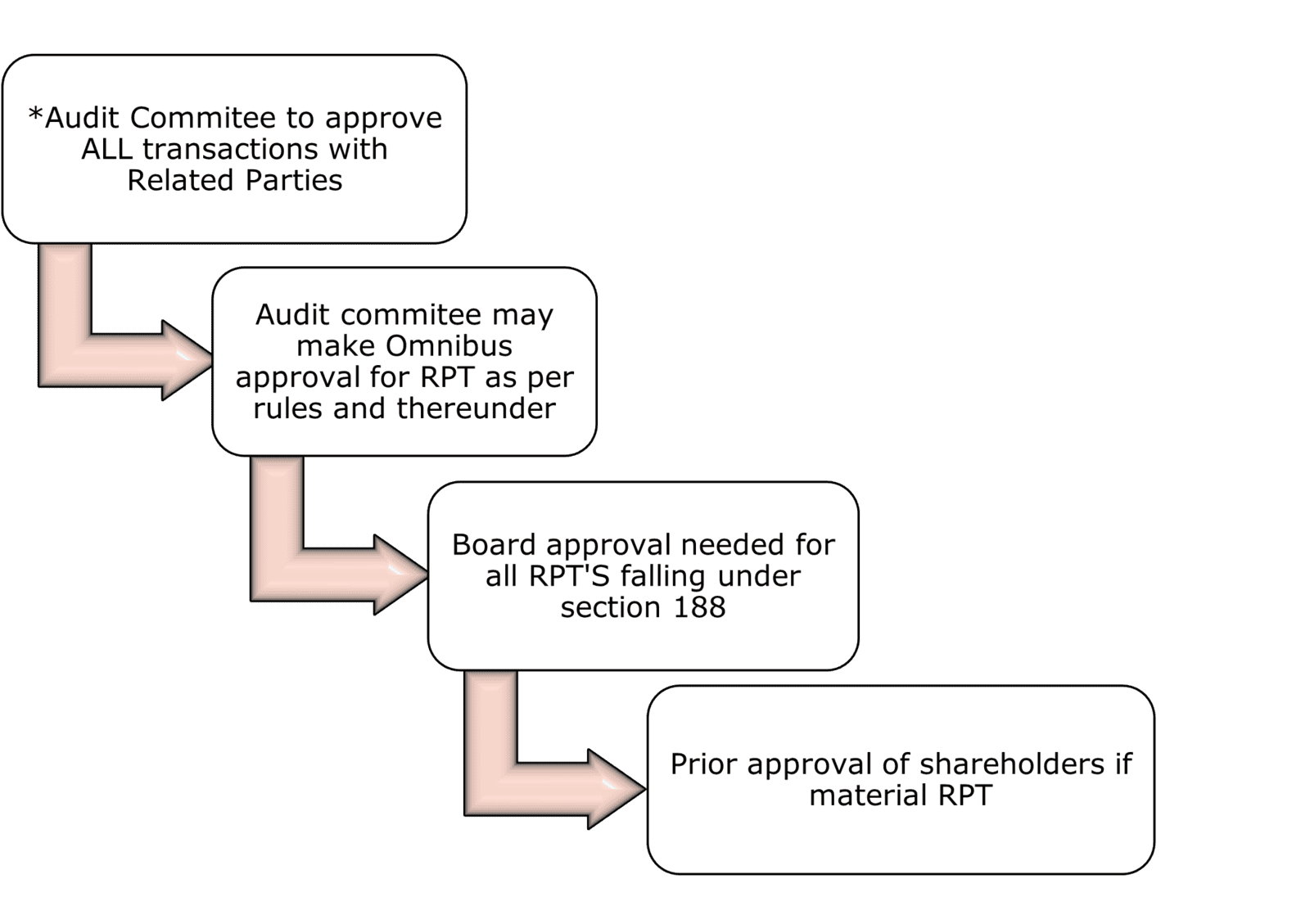

APPROVAL PROCEDURE UNDER COMPANIES ACT:

*Audit Committee is applicable as per Section 177 under Companies Act, 2013.

Key Governance Practices That Require Attention:

- Related Party not entitled to vote on Members’ Resolution

- If 90% of members are either related parties or relatives of Promoters, RPs can vote on Resolution.

- Audit Committee approval not necessary for Section 188 transactions between a Holding Company and its WOS.

- Shareholders resolution not necessary for transactions entered into between a holding company and its wholly owned subsidiary whose accounts are consolidated with such holding company and placed before the shareholders at the general meeting for approval.

Here is a recent case of governance threat related to a Related Party Transaction that occurred in India:

Blusmart Mobility Private Limited and Gensol Engineering Limited

Case in Brief:

Anmol Singh Jaggi, co-founder of Blusmart Mobility, also leads Gensol Engineering Ltd., a listed company. Gensol, a 12-year-old company, is closely linked to Blusmart, raising concerns about potential conflicts of interest and financial risks due to their intertwined operations. Blusmart’s fleet of 6,000 vehicles is largely leased from Gensol, accounting for over half of Gensol's assets under management in leasing. The preferential leasing terms give Blusmart a cost advantage over other customers, potentially disadvantaging Gensol’s minority shareholders. Despite claiming that the transactions were at "arm's length," Gensol did not seek shareholder approval or disclose the terms of these deals, raising concerns about transparency and fairness. This dual involvement could become costly for both companies as SEBI could soon launch a probe into alleged improprieties in related-party transactions of Gensol Engineering.

Possible Threat To Governance As Following Practices Are Observed:

i.Preferential Pricing: Undermines fair competition, benefiting insiders at the expense of the company’s financial health and shareholder interests.

ii.Undisclosed or Under-Disclosed Terms: Lack of transparency prevents informed decision-making, raising concerns about hidden conflicts of interest and potential financial manipulation.

iii.Profit Shifting: Distorts financial performance and undermines accurate reporting, creating risks related to tax avoidance and regulatory scrutiny.

iv.Asset Stripping: Depletes company resources, weakening financial stability and long-term value, while putting shareholders and employees at risk.

v.Over-Inflated Compensation: Mis-allocates company resources, reduces shareholder value, and damages trust by rewarding insiders without merit.

CONCLUSION:

Related party transactions, though essential in business, present significant governance challenges when not properly managed. The potential for conflicts of interest, lack of transparency, and unethical practices can compromise a company's financial integrity and harm shareholder interests. Ultimately, fostering a culture of accountability and transparency is key to maintaining trust and ensuring long-term sustainability in business practices. The risks highlighted by these issues call for stricter adherence to regulatory frameworks and ethical standards to safeguard all stakeholders.

Hemangi Mazire | Team Compliance

RBKRS & Associates LLP

Connect to Hemangi on Linked in - https://www.linkedin.com/in/hemangi-mazire-888762285/