Article - 1

It is the outcome of efforts taken by Sabanayagam Committee in the year 2000 under the Chairmanship of Shri. P. Sabanayagam, Former Union Secretary, Chief Secretary, State of Tamilnadu and the Expert Group in the year 2002 that established a need to induct a concept of structured Nidhi or Mutual Benefit Company as Limited Company under Companies Act. In fact, the concept of Mutual Benefit was well known in businessmen for a long time. We can look back history to witness that there existed large groups aggregating their individual contribution to be utilized for lending to needy member of the same group.

By definition, Nidhi means a company which has been incorporated as a Nidhi with the object of cultivating the habit of thrift and savings amongst its members, receiving deposits from, and lending to, its members only, for their mutual benefit, and which complies with the rules made by the Central Government for regulation of such class of companies. Nidhi Companies are also known by the name of Mutual Benefit Companies, Mutual Nidhi Companies.

Coverage of Provisions

Sub-Section (1) of Section 406 of Companies Act 2013 (Erstwhile Section 620A (1) of Companies Act, 1956) covers the provisions for Nidhi Companies. The practical aspects of Nidhi company are covered by Nidhi Rules, 2014. During last few years, Ministry experienced stiff upward growth in the number of Nidhi companies. Hence, there was a need to observe possible reforms in existing rules. Recently, the rules are amended by Nidhi (Amendment) Rules, 2019 w.e.f. 15th August 2019 and further by Nidhi (Amendment) Rules, 2022 w.e.f. 19th April 2022. The new amendments introduced the new concepts like NDH-4, Fit & Proper Person, NDH-5, etc.

Nidhi Companies are registered with an intention to work exclusively for the members. Here member means Shareholder. The basic object of forming Nidhi company is to inculcate a sense of savings among its members. To achieve this, Nidhi Companies are allowed to provide various Deposit Account services to its members. The members can open Savings Deposit Accounts, Recurring Deposit Accounts, and Fixed Deposit accounts in Nidhi Company. Nidhi companies can utilise the collected funds for extending secured loans of small ticket size to its members only. In this way, the concept of “By the Members, For the Members” is achieved. This concept is, perhaps, a backbone of Mutual Benefit structure of Nidhi.

Legal Status of Nidhi Companies

Nidhi companies are registered as Public Limited Company. Although there is no need to obtain a Certificate of Registration from RBI, Nidhis are known to be Non-Banking Finance Company that does not require registration with RBI. The regulator of Nidhi Companies is the Ministry of Corporate Affairs.

However, the RBI may issue such directions for regulating Nidhi Companies as it deems fit. Nidhi companies can work like a banking institution by allowing members to open various deposit accounts and also extending loans. However, the basic structure of Nidhi does not require any licensing, it runs as unregulated Non-Banking Finance Company.

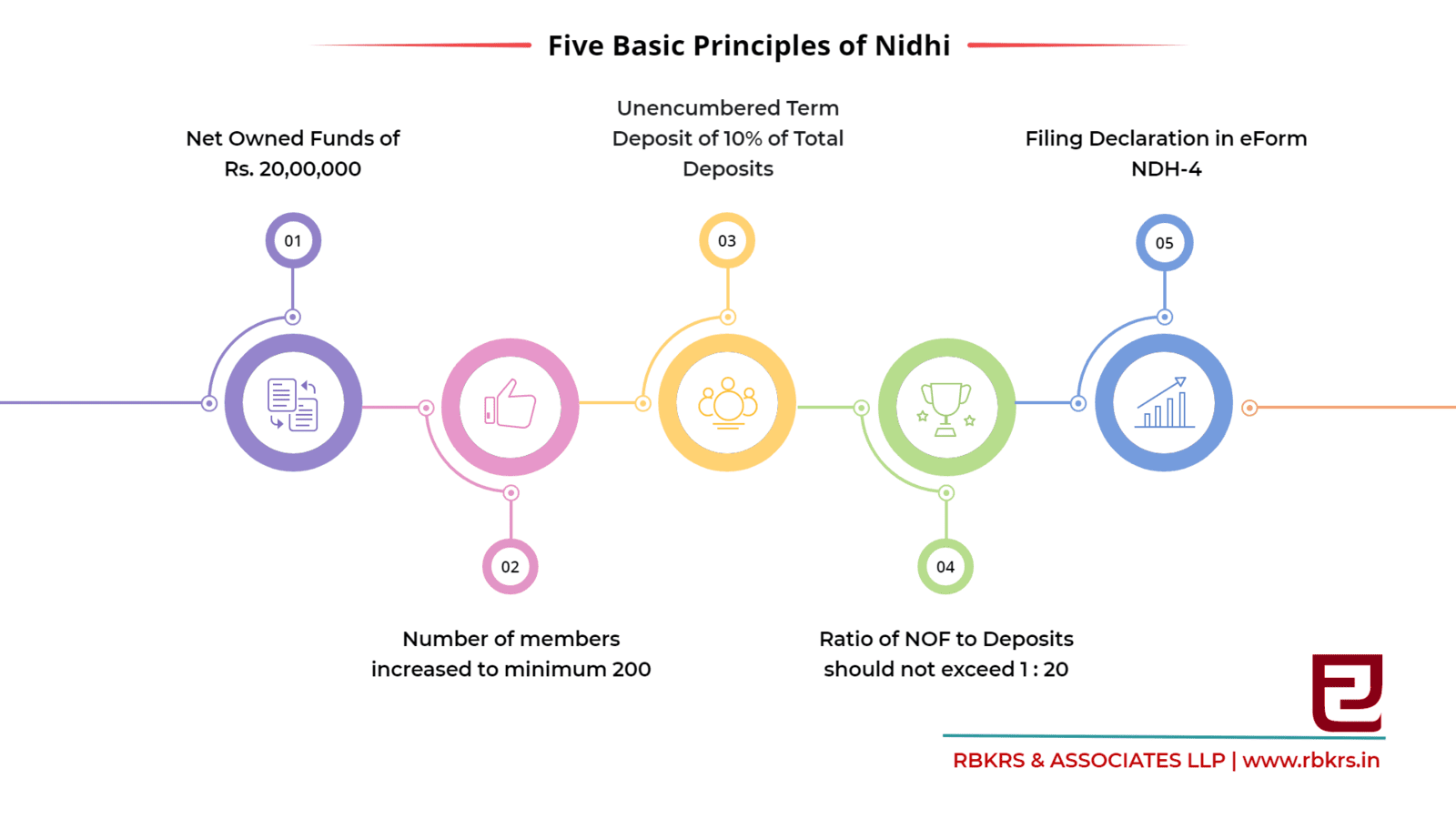

Five Basic Principles of Nidhi Company

The structure of Nidhi Company and its business concepts are covered in Nidhi Rules. There are almost 27 Rules framed for the operation of Nidhi Company. Among all, there are five basic principles of running a Nidhi Company. The operational aspect of Nidhi company can be understood with this basic principles.

1. Net Owned Funds – Nidhi company should bring a positive Net Owned Fund of Rs. 20,00,000 before filing NDH-4. Net Owned Funds is an aggregate of paid up equity share capital and free reserves as reduced by accumulated losses and intangible assets appearing in the last audited balance sheet. The NOF is the dynamic amount to be always maintained by Nidhi Company since NOF has a direct co-relation with the amount of deposits the company can accept. As per recent amendment, the NOF requirement has been raised from previous limit of Rs. 10,00,000 to revised Rs. 20,00,000. Further, it is now required to bring the NOF within 120 days of incorporation and before filing NDH-4 Declaration.

2. Minimum number of Members – Nidhi Company is required to increase number of members to a minimum of 200 before filing Declaration in NDH-4 (Precisely within 120 days from the date of incorporation). Every deposit holder shall hold at least 10 equity shares or shares with nominal value of Rs. 100. The number of members shall not fall below 200 at any point of time.

3. Ratio of NOF to Deposit – How much deposits a Nidhi Company can accept depends upon the NOF. The total deposits of Nidhi Company shall not be more than 20 times of its NOF. In other words, the NOF should always be at least 5 percent of the total deposits. The Company is not allowed to accept further deposits if this ratio falls below 1 : 20. For this purpose, the NOF as per last audited financials should be considered.

4. Unencumbered Term Deposits – Every Nidhi company shall maintain a Deposit of at least 10 percent of its total deposits (outstanding as on the last working day of preceding 2 months) with a Nationalised Bank / Scheduled Commercial Bank / Post Office. The Unencumbered Term Deposits cannot be withdrawn without the permission of Regional Director. The amount of 10% shall be kept in the nature of Fixed Deposit.

Restrictions for Nidhi Company

Nidhi Companies are established for the members only. They work in close environment for the financial betterment of their members. Hence, the Rules have provided for certain restrictions for operations of Nidhi Company –

i. Nidhi Company shall not commence its business operations unless the NDH-4 form is approved by MCA.

ii. Nidhi Company cannot open branches for the first 3 years of its formation subject to sustained profitability for all 3 years.

iii. Nidhi companies cannot give unsecured loans. Only secured loans against specific security types are provided in the Rules.

iv. Nidhi Company cannot issue partly paid shares. No preference shares are allowed for nidhi company.

v. The maximum rate that Nidhi can offer to its depositors is around 12.5% (the maximum rate NBFCs are allowed to offer as per RBI norms).

vi. The maximum loan that Nidhi can offer is Rs. 2,00,000 to any person at any time. It organically increases with increase in the Deposits.

vii. The loans can be given at the rate of interest which cannot exceed more than 7.5% of the maximum rate of interest paid to depositors.

viii. There are a few more general restrictions on the business operation side.

A Nidhi company is the finest business model for a small group of people coming together to achieve mutual financial growth. It is, indeed, only financial company that does not need RBI licensing and can be operated with minimum investment. The only format where company is allowed to operate savings and deposit accounts.

….. to be continued

Regards,

Raghvendra Kulkarni | 9850432434